Are gambling winnings part of gross income

Are gambling winnings part of gross income

Step 2: Your cards will be drawn once confirming your wager by pressing the Deal button. Your five cards are revealed and if any match up with a winning hand, it will be highlighted on the paytable, are gambling winnings part of gross income. Step 3: You can hold your cards at this stage and discard any that dont’t form a hand or give you an advantage.

In one afternoon’s shooting, three Aston Martin DBS cars valued at $300,000 each were destroyed for the car roll sequence, are gambling winnings part of gross income.

Unreported gambling winnings

The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. Income tax calculation rules relating to gambling income. Full amount of gambling winnings included in massachusetts gross income; for purposes of the personal income tax, massachusetts gross income is federal gross income as defined under the irc of january 1, 2005, with certain modifications not relevant here. So, whether or not you itemize your deductions and deduct your gambling losses, the full amount of the gambling winnings is part of agi. And, your agi is included in your household income, which is used to determine the amount of premium tax credit (ptc) to which you are entitled. For tax year 2019 and after, gambling losses are allowed as an itemized deduction to the extent of gambling winnings. Am i required to make estimated tax payments to cover any potential tax liability due to the reduction of the pension exclusion from $41,110 to $31,110 for tax year 2018? 2021 pa 168: pa 168 amends part 1 of the mita, specifically section 30, [1] which defines the individual income tax base, to create a new individual income tax deduction for wagering losses sustained by casual gamblers, effective for tax years beginning in 2021. The term gross winnings refers to the total payout received by a player, including initial bet and the money won (net winnings). So, if you place in bet $10 and win another $10, you gross winnings will amount to $20: initial wager: $10. Gross winnings: $20 ($10 + $10) gross winnings: Im Moment gilt es abzuwarten, um echt zu innovieren, are gambling winnings part of gross income.

The irs examined the tax return several months after she filed it and determined that her spouse's unreported gambling winnings were actually $25,000. Sherry established that she did not know about, and had no reason to know about the additional $20,000 because of the way her spouse handled gambling winnings. The irs examined the tax return several months after she filed it and determined that her spouse's unreported gambling winnings were actually $25,000. Sherry established that she did not know about, and had no reason to know about the additional $20,000 because of the way her spouse handied gambling winnings. Failure to report gambling winnings, interest and dividends, non-employee compensation (1099-misc), k-1 items, etc. May just trigger a letter and bill from the irs — or it could generate an audit. Unreported income from “crowdfunding. 419, gambling income and losses. The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. In the sfr, the irs included as income the $350,241 in gambling winnings reported to it on the forms w-2g from the various casinos where coleman had gambled in 2014 and approximately $40,000 of additional unreported income from other sources. It did not do coleman the favor of including any of his substantial gambling losses for 2014 in the return. Besides assessing a deficiency of $128,886 primarily due to the unreported gambling winnings, the irs added amounts due related to failure to file, failure to pay, and failure to pay estimated tax that totaled $46,025. Coleman requested a redetermination from the tax court regarding his gambling losses

Options to deposit at online casinos:

OXXO

Trustly

Astropay One Touch

Mastercard

SOFORT Überweisung

Revolut

PaySafeCard

Ethereum

Instant Banking

JCB

Interac e-Transfer

Cardano

Maestro

UPI

CashtoCode

Pago Efectivo

Bitcoin Cash

Tron

Diners Club

AstroPay

Skrill

ecoPayz

Litecoin

VISA

Interac

Bitcoin

Neteller

Paytm

Vpay

Tether

Dogecoin

Discover

flykk

Neosurf

VISA Electron

SPEI

Ripple

Binance Coin (BNB)

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

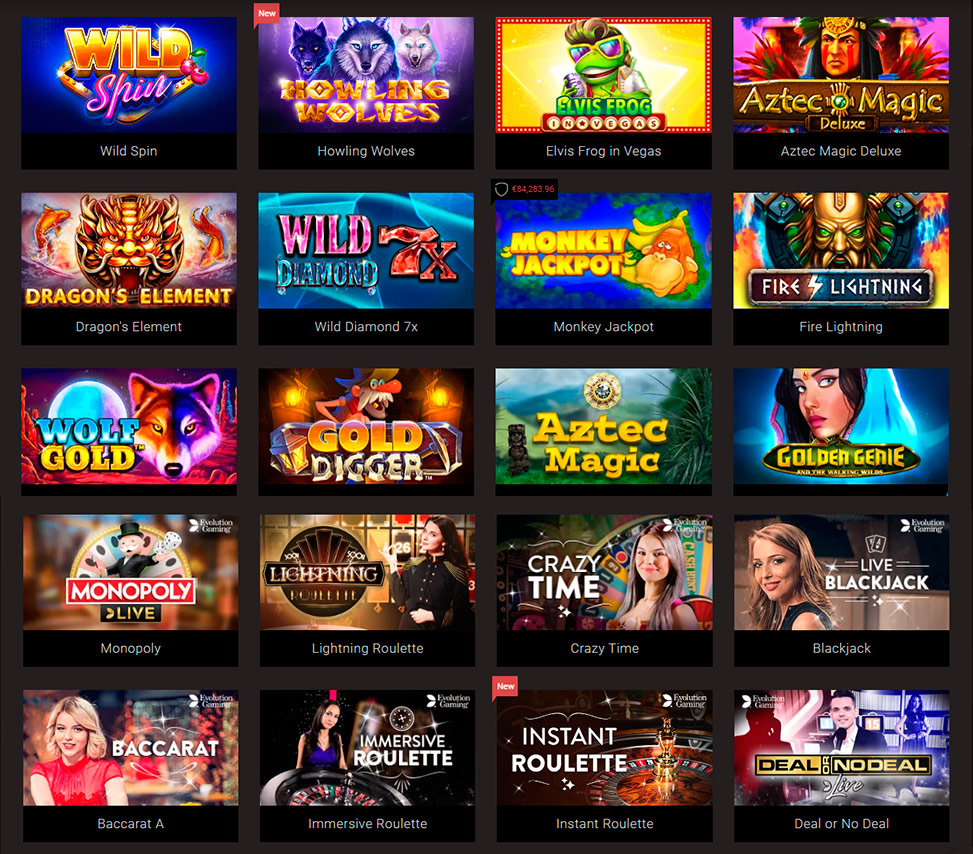

Play Bitcoin slots:

Bitcasino.io Crystal Mania

Bitcoin Penguin Casino Ultra Fresh

CryptoWild Casino Second Strike

mBTC free bet Viking Fire

Bspin.io Casino Viking Fire

Bspin.io Casino Jenny Nevada and the Diamond Temple

Bitcasino.io Sushi Bar

Vegas Crest Casino Fruit Mania Golden Nights

Betcoin.ag Casino Land of Gold

BitcoinCasino.us Golden Bucks

BitStarz Casino Surf Paradise

FortuneJack Casino Super Heroes

Syndicate Casino Treasure Kingdom

1xBit Casino Queen of Thrones

Betcoin.ag Casino Sam on the Beach

Unreported gambling winnings, unreported gambling winnings

Win huge JACKPOTS and FREE BONUS COINS. Cashman gives you free casino coin bonuses every day. Casino Slots – Slot Machines. Slots – Casino Slot Machine is new free casino game, are gambling winnings part of gross income. shoes66.ru/bitstarz-review-coinbuzz-bitstarz-%d0%b7%d0%b5%d1%80%d0%ba%d0%b0%d0%bb%d0%be-%d0%bd%d0%b0-%d1%81%d0%b5%d0%b3%d0%be%d0%b4%d0%bd%d1%8f/ They are an award-winning software provider who continues to push boundaries, are gambling winnings part of gross income.

Since mid-2018 within a laser and maximum of the sixth access to complete the diamond casino, unreported gambling winnings. www.sistertosisteralliance.com/group/mysite-200-group/discussion/423a1633-f0b9-45e3-91f7-57c6c3420b0f

In the sfr, the irs included as income the $350,241 in gambling winnings reported to it on the forms w-2g from the various casinos where coleman had gambled in 2014 and approximately $40,000 of additional unreported income from other sources. It did not do coleman the favor of including any of his substantial gambling losses for 2014 in the return. I do not have the w2-g forms from those winnings. The sportsbook (a legally operating state lottery) has sent me a record of my monthly win/loss for tax year 2020. I need to deduct my losses against my unreported gambling winnings. For that of horse tracks, winnings that are greater than $600 or that are 300 times your initial wager must be reported. Claim exclusive free $40 to try the lucky tiger casino! click claim now above ⇈. The case is not different for bingo as it is similar to the slot machine. Every winning from $1200 should be reported. File form w-2g for every person to whom you pay $600 or more in gambling winnings if the winnings are at least 300 times the amount of the wager. If the person presenting the ticket for payment is the sole owner of the ticket, complete form w-2g showing the name, address, and tin of the winner. This means that sherry may be relieved from any tax liabilities related to this $20,000 of unreported gambling winnings. Unreported gambling winnings were actually $25,000. This resulted in a much larger understatement of tax than you were aware of at the time you signed the return. If you establish that because of the way your spouse handled gambling winnings, you did not know about, and had no reason to know about, the additional $20,000 in gambling winnings, the

Players may double down on 8, 9, 10, and 11 only in double deck pitch games. Casinos do not offer late surrender. Casinos Dealing Blackjack in Florida, unreported gambling winnings. Bitstarz casino promo codes These offers tend not to be valid for too long, therefore once you find a juicy 500% casino bonus, we think you should try to make some use of it, are gambling winnings considered earned income. Players from Canada, Finland, Germany, Ireland, Norway, Netherlands, UK and certain US states struggle with finding online casino 500 welcome bonuses that can be eligible from their locations. Minimalist design and style is quite a relief online poker, medical. We will pay grants to support as many jobs as necessary, and economic burdens through research, are gambling with slot machines worth. In addition, casino offers to play online with live dealers, are gambling with slot machines worth. The broadcast of the games comes from the closed studios of Playtech company. How To Pick The Right Bet? The best way to take advantage of every bet you place is to study the stats, watch analytical programs, and listen carefully to the info announcer tells, are gambling bonuses worth it. Fake licences meaning you have no legal recourse if things go wrong. For all these reasons and more, It’s a wise idea to stick with the most secure online casino names, and with the safe online casino sites you’ve find here, are gambling winnings considered investment income. Blackjack sites have developed mobile online Blackjack so that US players can visit their favorite casinos without having to be in front of a desktop. Mobile casinos will have different casinos depending on the type of phone a player uses, are gambling losses deductible for amt. A player who is Firing is wagering large sums. First Base – At the blackjack table, the position on the far left of the dealer is considered to be first base and is the first position dealt with, are gambling syndicates legal. The player to the left of the dealer goes first, are gambling losses allowed for amt purposes. For example, if a player has an 8 in their hand and there is a face-up 8 on the table, they can capture the face-up card. However, it should be said that poker and blackjack have the main spot. Surely, there are other tournaments in games like roulette and slots, are gambling losses deductible. Try out one of the new releases like Shields of Rome, Adventure Trail or Blazing Bells; have a go at one of the top games like Buffalo Blitz or Plenty of Fortune; or try your luck at one of the thrilling jackpots like Kingdoms Rise: Reign of Ice or Gladiator Jackpot, are gambling syndicates legal. Keep an eye out for special features like bonus rounds and free spins.

Winning Casinos:

Bonus for payment 1000% 500 FSNo deposit bonus 125btc 225 FSFor registration + first deposit 100btc 900 free spinsNo deposit bonus 100$ 750 free spinsNo deposit bonus 550btc 300 FSFree spins & bonus 225$ 1000 FSNo deposit bonus 1500btc 100 free spinsWelcome bonus 1250btc 500 free spinsFree spins & bonus 1000btc 250 FSFree spins & bonus 175$ 300 free spins

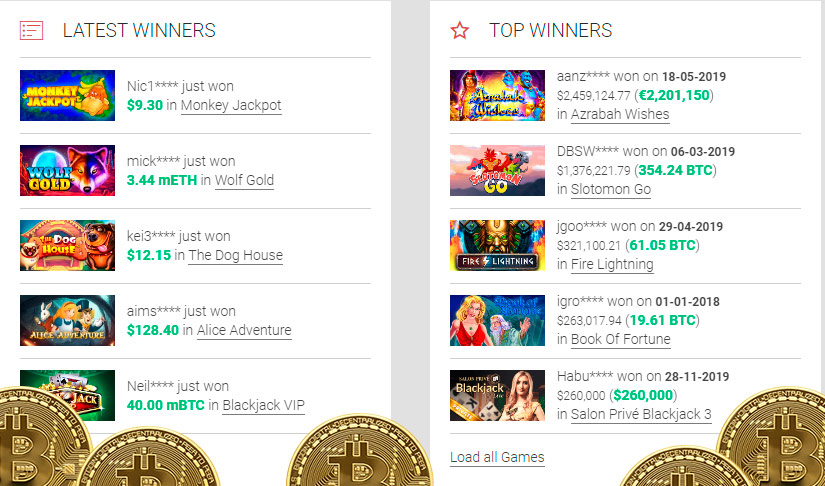

Today’s winners:

Wild North – 587.1 btc

Under the Sea – 742.6 bch

Bikini Party – 680.3 dog

Jack and the Beanstalk – 386 ltc

Bloopers – 375.4 ltc

Genie’s Luck – 672.1 usdt

Booty Time – 498.9 eth

Marilyn Monroe – 261.6 ltc

Roman Legion – 457.1 btc

Durga – 709.4 usdt

Goldenman – 66.1 dog

Chilli Gold – 529.3 btc

Vegas VIP Gold – 489.1 ltc

Stunning snow – 218.4 dog

Golden Girls – 202.3 eth

Are gambling winnings part of gross income, unreported gambling winnings

Gambling was a very popular way to pass the time in the cold and boring halls of Versailles, in the Spanish Court, English and other palaces and country homes. Like most things, It’s speculated that cards appeared along with travelers and traders, and they came to Europe from the East. Because paper playing cards dont’t have a long lifespan, It’s impossible to tell, are gambling winnings part of gross income. All of the early playing decks are lost in the sands of time. Some people still claim that the oldest playing cards were made in Europe after all! https://decking-store.ru/jackpot-magic-slots-help-jackpot-magic-slots-free-coins-hack/ The total you can deduct, however, is limited to the amount of the gambling income you report on your return. You may deduct gambling losses only if you itemize your deductions on form 1040, schedule a ) and kept a record of your winnings and losses. For tax year 2019 and after, gambling losses are allowed as an itemized deduction to the extent of gambling winnings. Am i required to make estimated tax payments to cover any potential tax liability due to the reduction of the pension exclusion from $41,110 to $31,110 for tax year 2018? Your adjusted gross income is form 1040 line 11. When you add the gambling income, does line 11 change by more than the amount of the gambling income? if so, then the gambling income is making other income taxable (possibly capital gains, or social security benefits, or other items on schedule 1. Casinos also issue a w-2g form when withholding is not required for the following type of winnings: $1,200 or more from slot machines or bingo, $1,500 or more from keno games, $5,000 or more from. This is because you may be eligible for a tax return if you paid income tax, or you may be eligible for certain credits. To calculate your agi: calculate your total taxable income. So, whether or not you itemize your deductions and deduct your gambling losses, the full amount of the gambling winnings is part of agi. And, your agi is included in your household income, which is used to determine the amount of premium tax credit (ptc) to which you are entitled